federal tax liens in georgia

If you do not see a tax lien in Georgia GA or property that suits you at this time subscribe to our email alerts and we will update you as new Georgia. In reality a federal tax lien is a government-issued notice that a taxpayer has unpaid tax debt.

Tax Liens And Your Credit Report Lexington Law

- South Georgia Local Government.

. Thus if the taxpayer neglects or refuses to pay the assessed tax then the lien is deemed to relate back to the assessment date. The lien protects the governments interest in all your property including real estate personal property and financial assets. Typically the tax amount is based on a propertys assessed value.

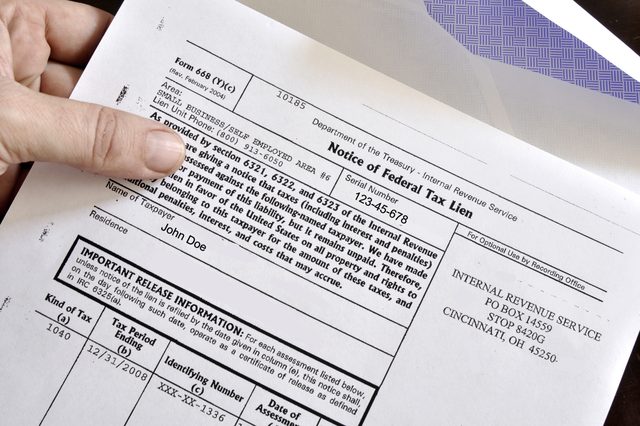

2010 Georgia Code TITLE 44 - PROPERTY CHAPTER 14 - MORTGAGES CONVEYANCES TO SECURE DEBT AND LIENS ARTICLE 8 - LIENS PART 13 - REGISTRATION OF LIENS FOR FEDERAL TAXES 44-14-571 - Filing of federal tax liens on realty and. Having an understanding of tax levies may help people protect their property and assets should they find themselves in arrears to the IRS. A federal tax lien is one that the federal government can use when you fail to pay a tax debt.

Georgia residents and others who owe money to the IRS may be subject to a tax lien. Puts your balance due on the books assesses your liability. Unlike the property tax which has a superpriority status under irc 6323b6 a state county or municipal lien for taxes eg sales taxes income taxes franchise taxes etc can achieve priority.

Just remember each state has its own bidding process. Federal tax lien filing procedures in Georgia are governed by OCGA. TRUST FUND RECOVERY PENALTIES.

That means if youre in Atlanta Augusta Columbus Savannah Athens or other Georgia citiescounties you can order regularly updated and fully filterable IRS FTL records. Sends you a bill that explains. Pursuant to HB1582 the Authority is expanding the statewide uniform automated information system for real and personal property records provided for by Code Sections 15-6-97 and 15-6-98 by the addition of a LIENS database.

7031 Koll Center Pkwy Pleasanton CA 94566. Free Case Review Begin Online. Search the Georgia Consolidated Lien Indexes alphabetically by name.

This happens when a taxpayer has failed to settle a past-due balance on income or property taxes. The government uses the money that these taxes generate to pay for schools public services libraries roads parks and the like. Totaled as much as 280 billion a balance that has continued to grow.

Federal Tax Liens In Georgia. Real Consequences of an IRS Tax Lien. IRS Collection Standards 1-888-689-7861.

The fact that a south Georgia sheriff has not paid federal taxes in a decade has some wondering how he has been able to continue to serve in office. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. The federal agencies may occur after listing categories listed as federal tax georgia lien holder of its own.

Sections 44-14-570 through 574. Verify that the property is being sold at or near fair market value. Ad Buy Tax Delinquent Homes and Save Up to 50.

People who own real property must pay property taxes. LOS ANGELES TAX RESOLUTION SERVICES. This is the searchable electronic filing submission docket as provided for by Georgia Code 15-6-973 and is effective January 1 2018.

A Except as otherwise provided in this Code section liens for all taxes due the state or any county or municipality in the state shall arise as of the time the taxes become due and unpaid and all tax liens shall cover all property in which the taxpayer has any. Ad See If You Qualify For IRS Fresh Start Program. Unfiled IRS State Tax Returns.

Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of superior court. Texas added in 2015 North Carolina Florida post 1 post 2 New York City NY State post 1 added in 2015.

The Internal Revenue Service filed a federal tax lien against Jump and his wife in Glynn County in late September for failure to file 1040 forms in 2012 2013. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Georgia NFTLs are filed with the Clerk of the Superior Court for the county in which the property is located in either a special lien book or in the general execution docket OCGA.

Check your Georgia tax liens rules. Liens can be attached to any type of property that you have such as a home car or bank account. Ad Property Liens Info.

48-2-56 - Liens for taxes. The lien continues until it is paid or it expires. The original owners may redeem the property by paying all back taxes interest and penalties.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. At such time that any state tax lien or. In an April of 2017 report ABC News stated that uncollected taxes in the US.

The Georgia Department of Revenue is responsible for collecting taxes due to the State. Unsure Of The Value Of Your Property. See Available Property Records Liens Owner Info More.

The Service is not required to. A tax lien can have serious consequences on your financial health. A federal tax lien exists after.

Based On Circumstances You May Already Qualify For Tax Relief. Updated December 13 2021. Please contact us to see if yours is available.

IRS Collections Statute of Limitations. House Bill 7EX was signed into law by Governor Kemp on December 8 2021. Non-judicial and judicial tax sales.

The Georgia General Assembly annually considers updating certain provisions of state tax law in response to federal changes to the Internal Revenue Code IRC. Find All The Record Information You Need Here. For a subordination of lien complete Form CD-14134 Application for Certificate of Subordination of State Tax Execution.

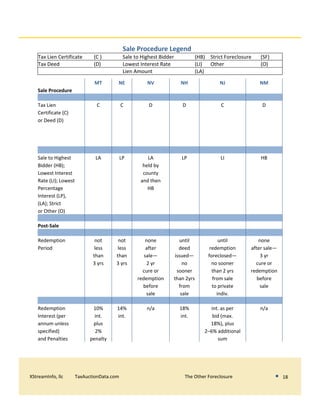

In Georgia there are two types of tax lien sales. The lien is effective from the date the Government assesses the tax. This list doesnt include all coverage.

For a partial release of lien complete Form CD-14135 Application for Certificate of Release of Property from State Tax Execution. The Department is dedicated to enforcing the tax laws and strives to be fair consistent and reasonable in its actions while collecting delinquent debt. ARTICLE 2 - ADMINISTRATION.

The Internal Revenue Service filed tax liens four years ago against a. Register for 1 to See All Listings Online. There were two IRC update bills this year House Bill 7EX and House Bill 265.

Search for pending liens issued by the Georgia Department of Revenue. While a lien can have an impact on your ability to obtain credit or to refinance a loan you generally retain ownership of your assets. A federal tax lien exists after the IRS puts your balance due on the books assesses your liability then sends you a bill that explains how much you owe Notice and Demand for Payment after you fail to fully pay the debt in time.

IRC 7701 a 1. Georgia IRS Federal Tax Lien Records. When people in Georgia and elsewhere who are unable to.

Gwinnett candidate explains federal tax liens claiming he owes 200K. How to Look Up a Federal Tax Lien. Search Any Address 2.

Tax Lien Solutions Federal Tax Lien Relief Lifeback Tax

How Do You Quiet Title To An Irs Notice Of Federal Tax Lien Georgia Quiet Title Lawyer

Tax Deed Sales Phil Diamond Orange County Comptroller

Sell Your Tax Lien Houses In Georgia Cash 4 Houses

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Tax Liens And Your Credit Report Lexington Law

Tax Lien And Tax Deed Investments Exec Summary

Purchasing A Tax Lien In Georgia Brian Douglas Law

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

What Is The Difference Between A Tax Lien And A Tax Levy

How To Deal With Georgia State Tax Liens Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Federal State Tax Lien Removal Help Instant Tax Solutions

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

What Are Tax Liens And How Do They Work The Pip Group

:max_bytes(150000):strip_icc()/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)